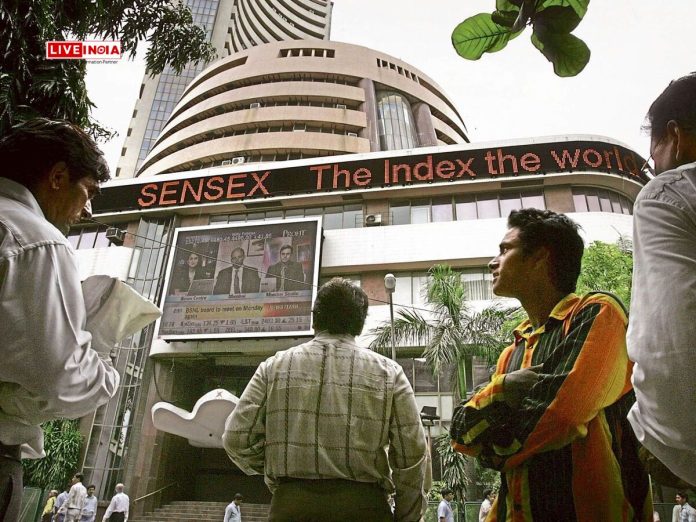

"Indian stock markets face a steep fall due to rising US bond yields, foreign portfolio investor outflows, and macroeconomic jitters, with IT sector being the sole gainer."

January 11, 2025: New Delhi: The Indian stock markets saw another day of losses on January 10, with Sensex and Nifty 50 falling for the third consecutive session. A combination of weak global cues, rising US bond yields, and heavy selling by foreign portfolio investors (FPIs) have wiped out approximately ₹12 lakh crore in investor wealth over three trading days.

Market Performance

The Sensex opened at 77,682.59, dropped over 500 points during the day, and closed 241 points, or 0.31%, lower at 77,378.91. The Nifty 50 followed suit, opening at 23,551.90 before closing at 23,431.50, registering a 0.40% drop.

The selloff was sharper in mid-cap and small-cap segments, with the BSE Midcap and Smallcap indices plunging 2.13% and 2.40%, respectively.

Sectoral Impact

Most sectoral indices recorded losses, except for the Nifty IT index, which surged 3.44%, driven by positive Q3 results from Tata Consultancy Services (TCS). The biggest losers included Nifty Media (-3.59%), Realty (-2.77%), PSU Bank (-2.72%), and Healthcare (-2.21%).

Factors Driving the Decline

- Cautious Earnings Outlook:

Investors are treading cautiously as India enters the Q3 earnings season. While TCS delivered results in line with expectations, broader sentiment remains subdued. - Rising US Bond Yields and Dollar:

US Treasury yields reached eight-month highs on Friday, with the dollar strengthening against the rupee. This has led to a capital flight from emerging markets like India. - Heavy FPI Outflows:

FPIs have sold Indian equities worth over ₹19,000 crore till January 9, amid concerns about US Fed policy and global trade uncertainties. - Macroeconomic Concerns:

India’s GDP growth forecast for FY2024-25 has been pegged at 6.4%, the slowest in four years, adding to investor worries. - Uncertainty Over US Fed Policy and Trade:

Speculation over Donald Trump's trade policies and the US Federal Reserve’s rate outlook has further dampened global investor sentiment.

Expert Opinions

V.K. Vijayakumar, Chief Investment Strategist at Geojit Financial Services, stated, “With FII selling, the performance of banking and other sectors may remain muted despite positive earnings.”

Shrikant Chouhan, Head of Equity Research at Kotak Securities, warned traders of further downside risks, highlighting key levels of 23,650/78,000 as critical for recovery.

Reliance Securities noted that the Nifty 50 has entered a bearish zone, with the next support at 23,250 levels.

Tags:

Sensex fall, Nifty 50, Indian stock market, US bond yields, FPI outflows, IT sector gains, TCS Q3 results, macroeconomic concerns, Indian rupee vs dollar.