Economic headwinds and global uncertainties may limit short-term returns but offer long-term opportunities

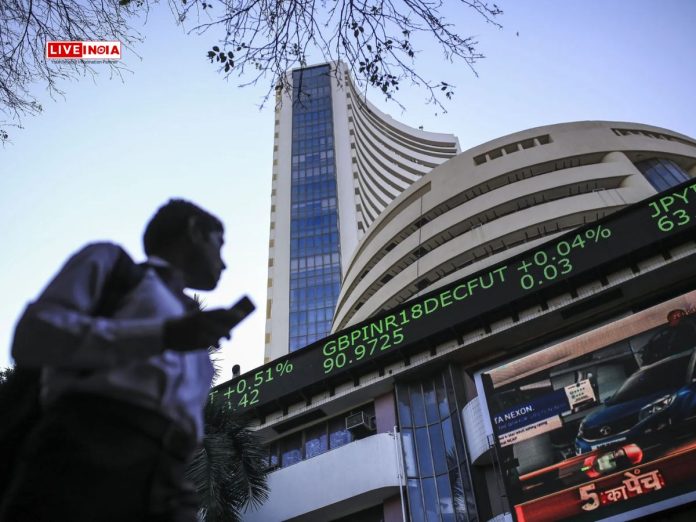

Mumbai, January 13: Klay Securities Private Limited, a prominent boutique financial services firm, has forecasted a challenging first half of 2025 for Indian equities. According to Ravi Malani, Senior Analyst at Klay Securities, a confluence of domestic and global factors may curtail market growth in the near term, but these challenges could pave the way for lucrative opportunities for long-term investors.

Domestic Challenges Impacting Growth

India's economy faces a range of headwinds, including:

- A seven-quarter low in economic growth

- Persistently high inflation

- Delayed government spending

- A slowdown in manufacturing and urban demand

Earnings growth has stagnated at just 5% year-over-year, leading to a de-rating of Indian equities. "The transitory nature of these challenges limits fundamental upside for Indian stocks as we move into 2025," said Malani.

Market Patterns Signal Caution

Klay Securities notes that historical trends and technical indicators suggest caution:

- The record 90 IPOs in 2024 mirror previous years like 2017 and 2021, which were followed by market corrections.

- The market capitalization-to-GDP ratio is at 147%, exceeding the 10-year average by 50%, signaling potential overvaluation.

Global Factors Adding to Uncertainty

On the global stage, changes in U.S. monetary policy under the new administration, coupled with potential currency devaluations and a likely rate hike by the Bank of Japan, could strengthen the U.S. dollar (DXY) to 112. This could trigger foreign portfolio investor (FPI) outflows from emerging markets like India, adding to the volatility.

Opportunities for Long-Term Investors

Despite these challenges, Klay Securities highlights the correction as an ideal time for long-term investors to focus on stock-picking. "This will not be a market driven by trends, but by identifying high-quality stocks with strong fundamentals," emphasized Malani.

About Klay Securities

Part of the global Klay Group, the firm specializes in wealth management, asset management, and corporate advisory. Renowned for its client-centric approach, the group utilizes insights from over 4,000 analysts worldwide to offer tailored financial solutions.