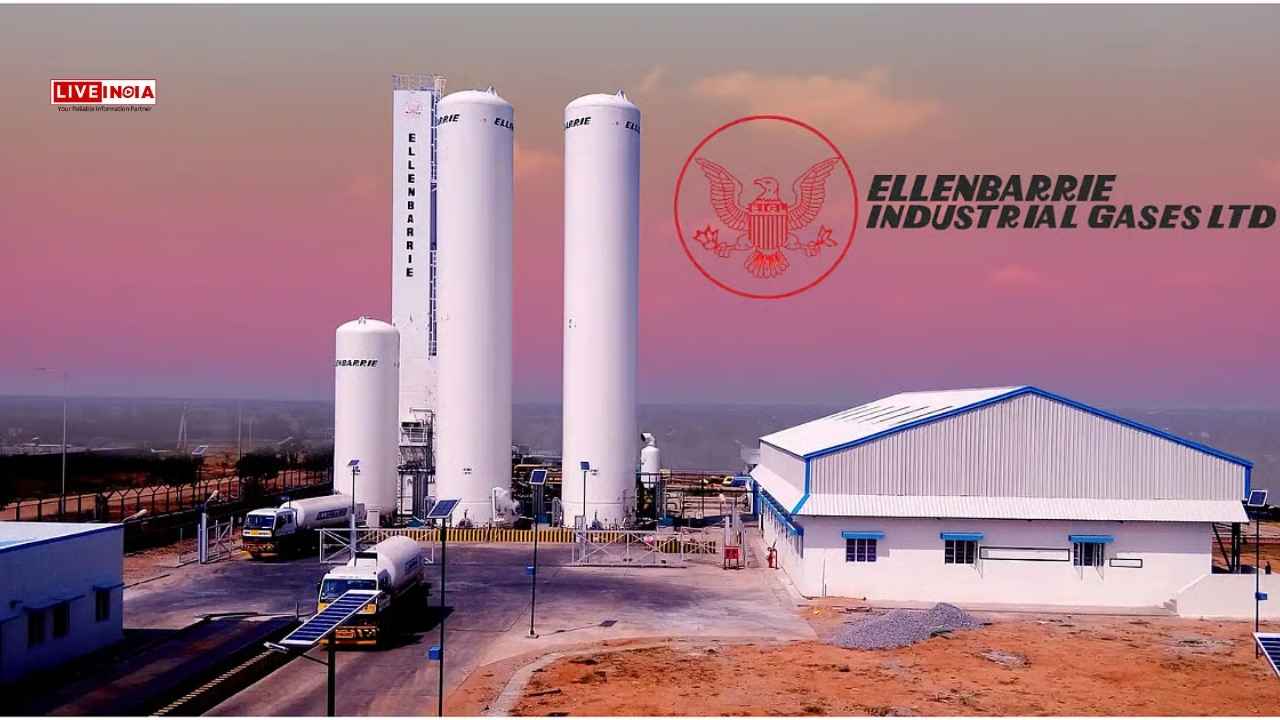

Ellenbarrie Industrial Gases IPO Listing Tomorrow: Grey Market Premium Signals This Much Gain

Mumbai, June 30, 2025 —

The highly anticipated Ellenbarrie Industrial Gases IPO is set to debut on the stock exchanges tomorrow, July 1, after recording a strong subscription of 22.19 times across investor categories. The shares are expected to list at ₹456 apiece, a 14% premium over the issue price of ₹400, based on the current grey market premium (GMP) of ₹56.

Also Read: LiveIndia Market Updates: MRPL Stock Steady Amid Marginal Dip in Early Trade

The IPO allotment was finalised on June 27, and the shares are being credited to investors’ demat accounts today, June 30. Refunds for non-allottees will also be processed today.

The public offer, open from June 24 to June 26, witnessed enthusiastic participation:

Also Read: LiveIndia Update – Nestle India Share Price Steady Today

Ellenbarrie’s IPO had a price band of ₹380–₹400 per equity share. The stock will be listed on both BSE and NSE.

According to grey market tracker investorgain.com, the IPO GMP has ranged from ₹0 to ₹58 over the past 18 days, indicating bullish sentiment. The current GMP of ₹56 suggests a listing price of ₹456, pointing to strong investor confidence and listing day optimism.

Also Read: LiveIndia Market Updates: Waaree Energies Shares Shine With 2.3% Rally in Morning Trade

The IPO consisted of:

The total issue size is estimated at nearly ₹977 crore.

Proceeds from the fresh issue will be used to:

As of April 2025, the company’s outstanding debt stood at ₹264.2 crore.

Ellenbarrie manufactures and supplies industrial gases, dry ice, synthetic air, firefighting gases, medical oxygen, and specialty gases across multiple sectors. The listing is expected to further strengthen its position in the industrial gases segment.

Motilal Oswal Investment Advisors, IIFL Capital Services, and JM Financial are lead managers, with KFin Technologies acting as registrar.

Ellenbarrie Industrial Gases IPO, IPO listing July 1, Ellenbarrie IPO GMP, grey market premium, Ellenbarrie share price, stock market news, IPO subscription status, Ellenbarrie allotment update, industrial gases sector, NSE IPO, BSE listing, upcoming IPOs India

Sunny Deol and Akshaye Khanna face off in a high-stakes courtroom drama of ethics and…

No refund for Vande Bharat and Amrit Bharat tickets cancelled within eight hours of departure…

Services to four destinations suspended till February 28 over regional security concerns February 3, 2026:…

Eight Opposition MPs suspended after repeated disruptions over national security debate February 3, 2026: The…

Makers consider recast after Deepika Padukone’s exit from Kalki 2898 AD 2 February 3, 2026:…

Former India captain calls award a special moment, vows to keep winning matches for the…