July 7, 2025: Oriental Trimex Ltd., a well-known name in the marble processing and import business, is making headlines once again. On July 4, 2025, the company’s stock closed 2.48% higher at ₹14.05, following a major update about its business strategy aimed at improving operational efficiency and reducing costs.

Oriental Trimex’s Latest Strategic Move

In a regulatory filing, the company announced its plan to sell certain non-core assets located in Odisha. This includes a 7-acre land parcel in the Somanathpur Industrial Estate in Balasore and a small granite processing unit in Rairangpur, Mayurbhanj district. According to the company, this move will help streamline operations, reduce recurring expenses, and boost liquidity for more focused investments.

Commercial Production to Begin from New Black Granite Mine

In a significant development, Oriental Trimex also revealed that it is ready to begin mining operations at its black granite mine in Poteru village, Malkangiri district, Odisha. The company had secured a mining lease for 4.961 hectares from the state government in May 2025. Commercial production is expected to start soon, which could contribute positively to the company’s revenues and profitability.

New Smart-Cut Technology to Enhance Efficiency

The company also announced the deployment of a new ultra-thin wire “Smart Cut” machine, which is designed to reduce material wastage by up to 20%. This advanced technology is expected to improve overall yield and profit margins.

Rising Demand in the NCR Real Estate Market

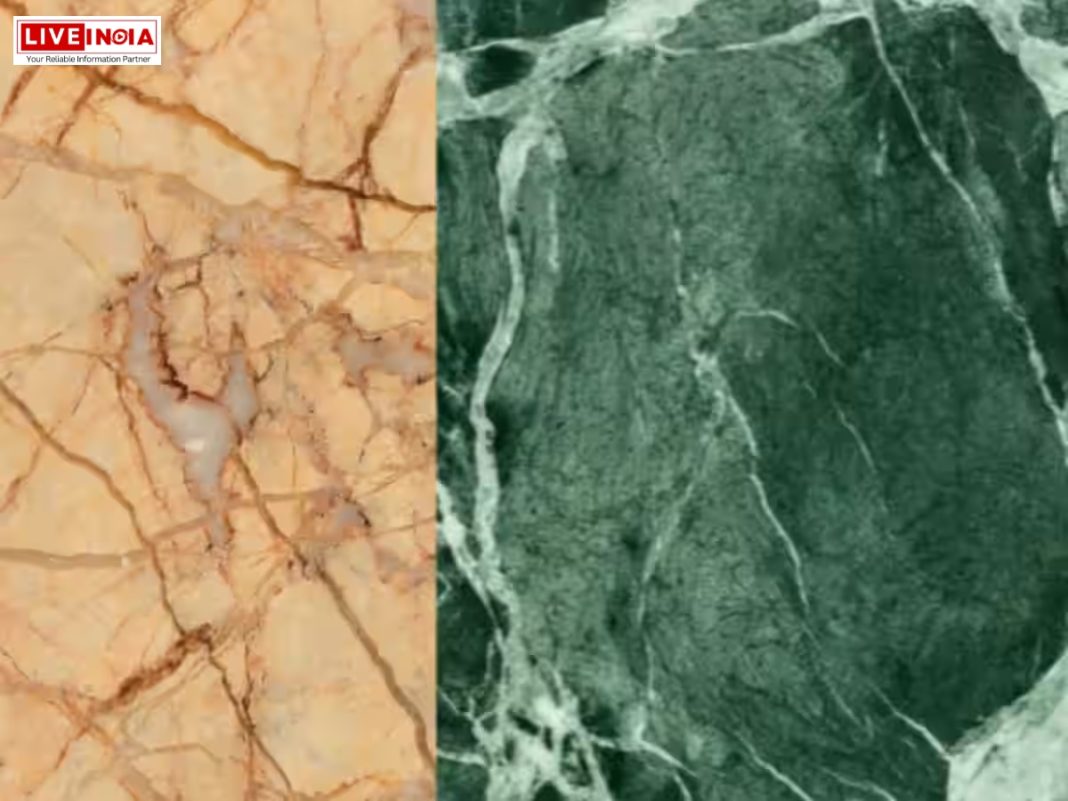

Oriental Trimex is also benefiting from the growing trend of luxury apartment development in the National Capital Region (NCR). The company’s range of products, which includes high-quality imported marble, indigenous granite, and marble-design vitrified tiles, is seeing strong demand from leading real estate developers.

Oriental Trimex Share Performance

The stock has delivered impressive returns across different time frames:

- Last 3 months: Up over 54%

- Last 6 months: Up 43%

- Year-to-date (2025): Up 48%

- Past 1 year: Gained 57%

- Past 2 years: Delivered 190% return

The 52-week high of ₹17.63 was recorded on June 18, 2024, while the 52-week low stands at ₹7.82.

Conclusion

Oriental Trimex appears to be on a strategic growth path by exiting non-core operations and focusing on high-potential ventures like black granite mining and advanced cutting technology. With strong tailwinds from the real estate sector and improving operational metrics, the stock could remain in focus in the coming months.