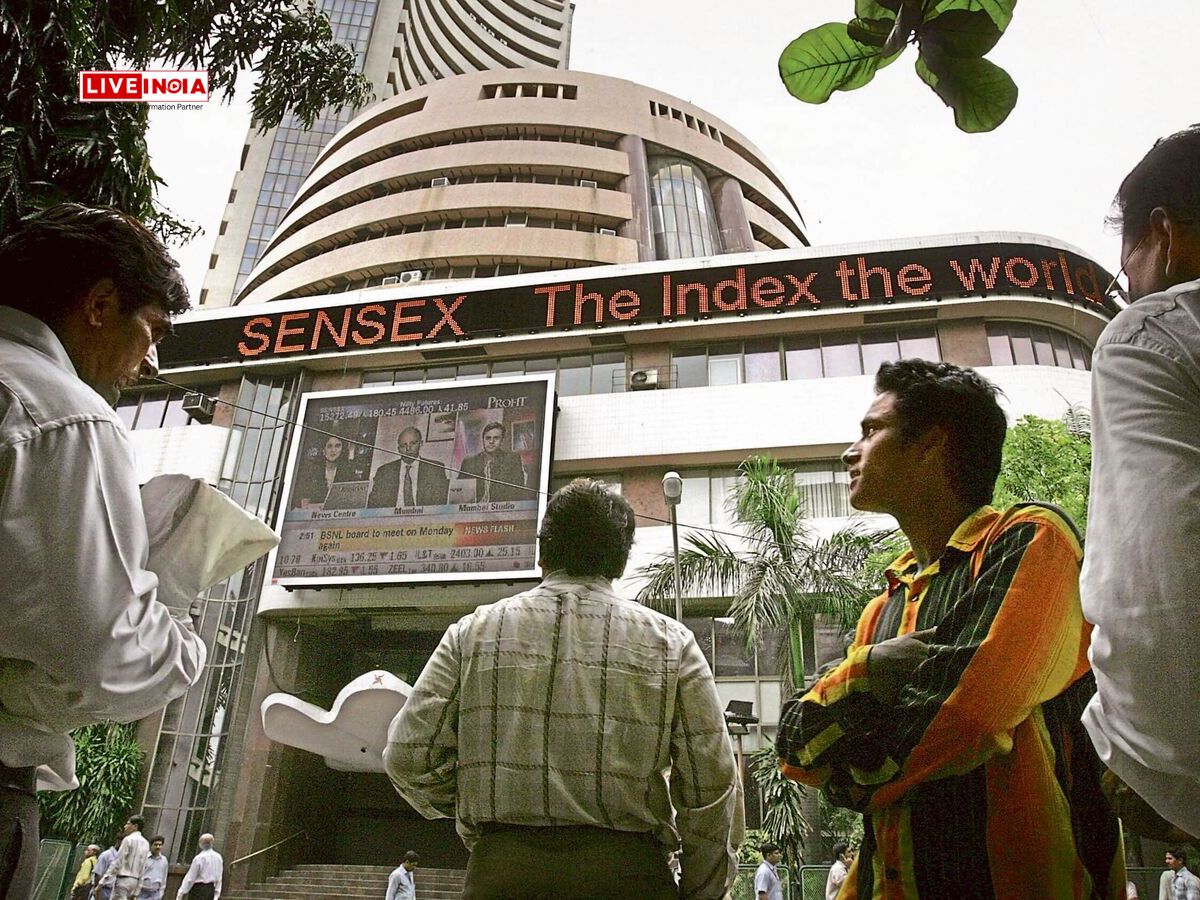

January 11, 2025: New Delhi: The Indian stock markets saw another day of losses on January 10, with Sensex and Nifty 50 falling for the third consecutive session. A combination of weak global cues, rising US bond yields, and heavy selling by foreign portfolio investors (FPIs) have wiped out approximately ₹12 lakh crore in investor wealth over three trading days.

The Sensex opened at 77,682.59, dropped over 500 points during the day, and closed 241 points, or 0.31%, lower at 77,378.91. The Nifty 50 followed suit, opening at 23,551.90 before closing at 23,431.50, registering a 0.40% drop.

The selloff was sharper in mid-cap and small-cap segments, with the BSE Midcap and Smallcap indices plunging 2.13% and 2.40%, respectively.

Most sectoral indices recorded losses, except for the Nifty IT index, which surged 3.44%, driven by positive Q3 results from Tata Consultancy Services (TCS). The biggest losers included Nifty Media (-3.59%), Realty (-2.77%), PSU Bank (-2.72%), and Healthcare (-2.21%).

V.K. Vijayakumar, Chief Investment Strategist at Geojit Financial Services, stated, “With FII selling, the performance of banking and other sectors may remain muted despite positive earnings.”

Shrikant Chouhan, Head of Equity Research at Kotak Securities, warned traders of further downside risks, highlighting key levels of 23,650/78,000 as critical for recovery.

Reliance Securities noted that the Nifty 50 has entered a bearish zone, with the next support at 23,250 levels.

Sensex fall, Nifty 50, Indian stock market, US bond yields, FPI outflows, IT sector gains, TCS Q3 results, macroeconomic concerns, Indian rupee vs dollar.

Indirect Muscat negotiations face agenda dispute as US urges citizens to leave Iran February 6,…

Production house rejects claims linking Delhi missing girls rumours to film publicity February 6, 2026:…

‘Tere Sang’ teaser goes viral ahead of Valentine’s Week release February 6, 2026: Singer Arijit…

Former Bigg Boss 9 contestant and singer Suyyash Rai has sparked a social media firestorm…

Congress MLC says Siddaramaiah will remain CM for full five-year term February 6, 2026: Congress…

In a major legal blow, Bollywood actor Rajpal Yadav surrendered to the Tihar Jail authorities…