The $5,400 Target: Goldman Sachs Bullish on Gold for 2026

The “gold rush” of the mid-2020s shows no signs of slowing down. Goldman Sachs has officially raised its gold price forecast for the end of 2026 to a staggering $5,400 per ounce, up from its previous estimate of $4,900. This revision follows a year of unprecedented growth, with gold already climbing more than 11% in the first few weeks of 2026 after a massive 64% rally in 2025.

The surge is being driven by a “structural shift” in how the world views bullion, moving it from a speculative asset to a necessary hedge against a volatile global landscape.

According to the latest notes from the investment bank, the bull case for gold rests on three main pillars:

In India, global price hikes are amplified by currency fluctuations. If gold hits the $5,400 mark internationally, domestic prices are expected to skyrocket.

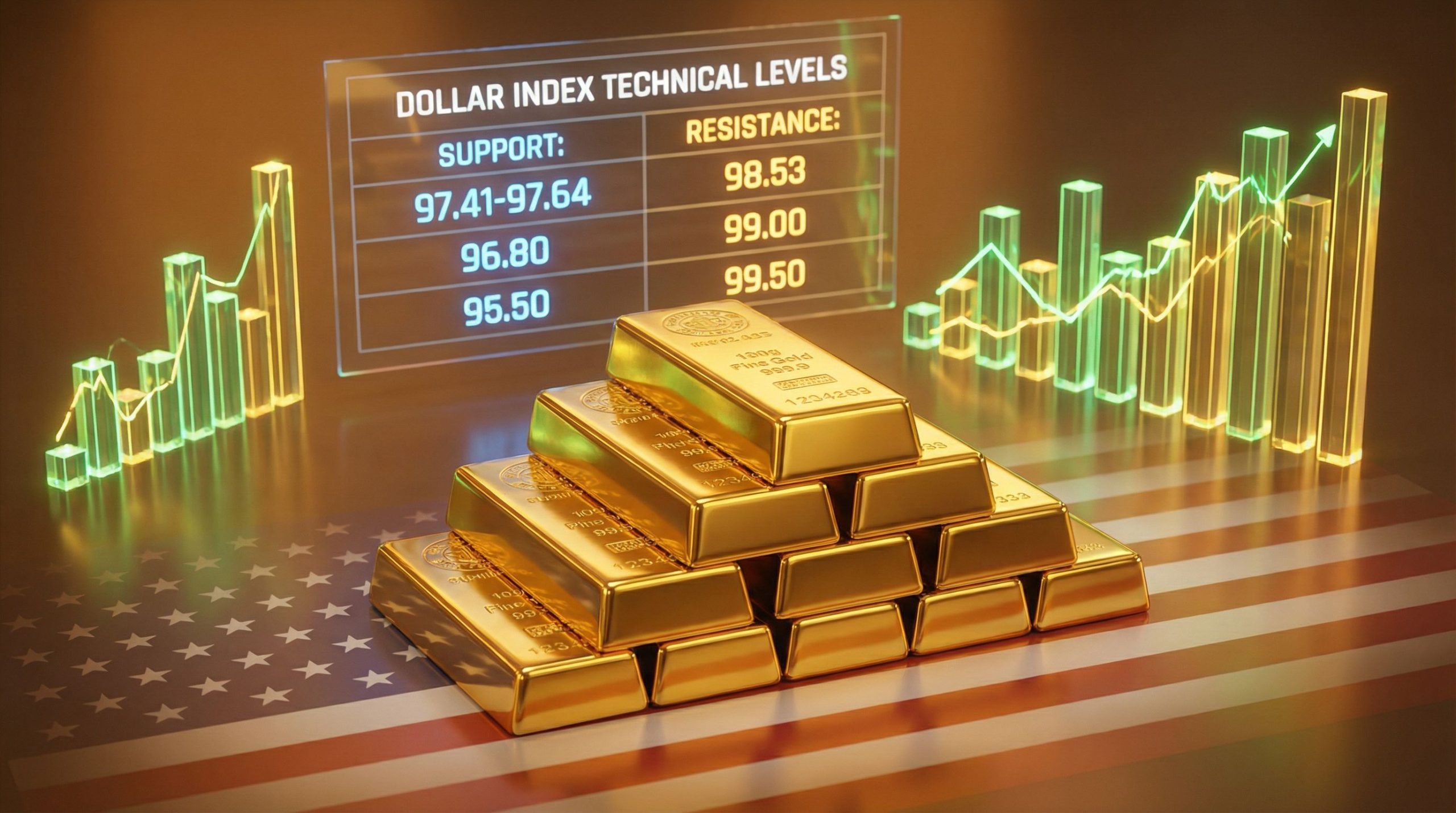

While the long-term outlook is bullish, the journey hasn’t been without bumps. Just this week, prices saw a sharp “profit-taking” dip after President Trump softened his stance on European tariffs and the annexation of Greenland. This de-escalation briefly boosted the US dollar and cooled safe-haven demand, showing just how sensitive the metal is to the daily news cycle.

However, with other major banks like Citi, JPMorgan, and Bank of America all eyeing the $5,000+ mark, the consensus is clear: the glitter isn’t fading anytime soon.

Podcast row escalates as actor denies allegations, host alleges online harassment February 11, 2026: A…

Industry rallies behind actor as bail hearing looms in cheque bounce case February 11, 2026:…

Rahul Gandhi’s remarks spark sharp rebuttal from Hardeep Singh Puri during Budget Session February 11,…

Ten killed, 25 injured in British Columbia attack; India stands in solidarity February 11, 2026:…

Lok Sabha sees heated exchange after LoP calls pact a ‘surrender’ February 11, 2026: The…

Actor among 13 accused in alleged lakhs fraud case in Mainpuri February 11, 2026: Actor…