PM Modi invokes Goddess Lakshmi, sparking speculation about potential income tax benefits in the Union Budget 2025.

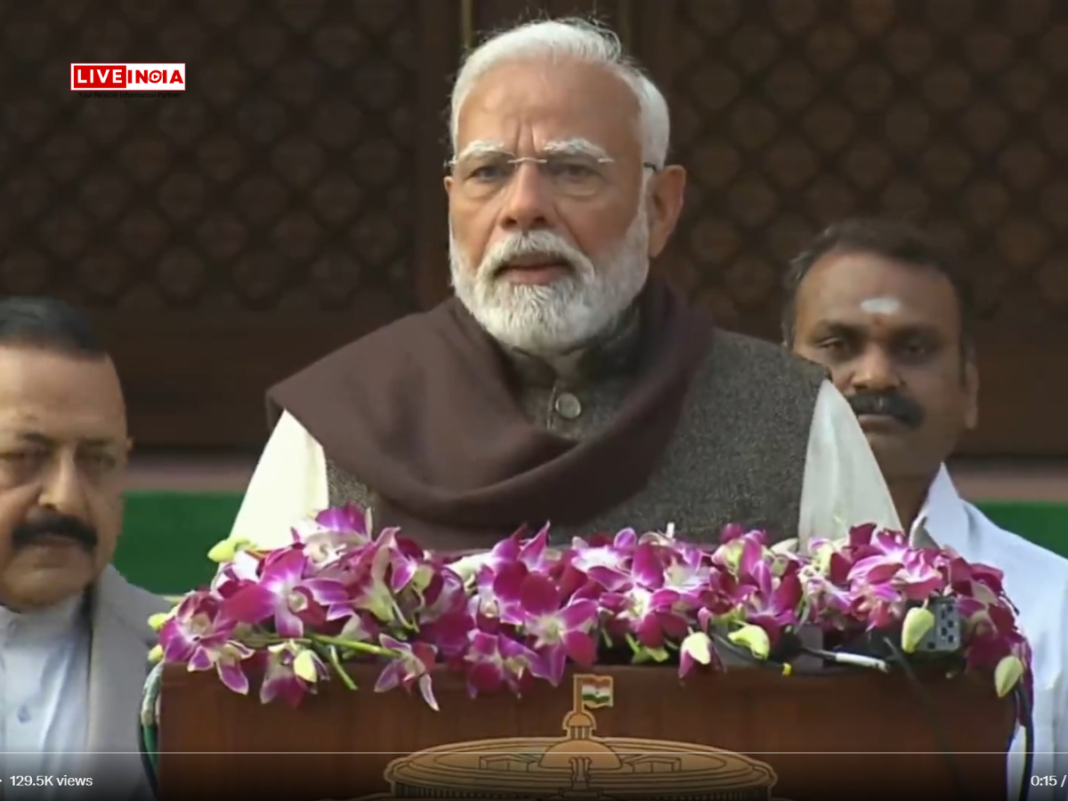

January 31, 2025: New Delhi: As Finance Minister Nirmala Sitharaman prepares to present the Union Budget 2025, Prime Minister Narendra Modi’s remarks during the opening session of Parliament have raised hopes for middle-class taxpayers. Invoking Goddess Lakshmi, PM Modi stated, “I pray that Goddess Lakshmi showers blessings upon the poor and middle class.”

PM Modi also highlighted India’s 75-year journey as a democratic nation and expressed confidence in achieving the vision of “Viksit Bharat” by 2047. “Innovation, inclusion, and investment form the basis of our economic roadmap. This Budget session will infuse new confidence and energy into the nation,” he added.

Also Read: Budget Session 2025 Kicks Off: Nirmala Sitharaman to Present Economic Survey

His mention of the middle class, coupled with the timing of his remarks, has sparked speculation about potential income tax relief in Budget 2025.

Anticipated Income Tax Reforms

Also Read: Budget 2025: Modi Government to Present Economic Survey Ahead of Union Budget

Taxpayers have long awaited changes to the income tax structure, including a cut in rates, revisions in tax slabs, and an increase in standard deductions. Economists have suggested such measures to boost consumption and alleviate the burden on middle-class families.

The current New Tax Regime offers the following slabs:

| Income Range | Tax Rate |

|---|---|

| ₹0 – ₹3,00,000 | Nil |

| ₹3,00,000 – ₹7,00,000 | 5% |

| ₹7,00,000 – ₹10,00,000 | 10% |

| ₹10,00,000 – ₹12,00,000 | 15% |

| ₹12,00,000 – ₹15,00,000 | 20% |

| Above ₹15,00,000 | 30% |

- Rebate: Taxpayers earning up to ₹7,00,000 are eligible for a rebate of ₹25,000 under the new regime.

Economic Context and Expectations

The Union Budget 2025 comes at a critical time, as India’s GDP growth has slowed to 5.4%—the lowest in two years. Tax experts argue that rationalizing tax slabs and offering income tax relief could stimulate spending and economic growth.

This marks the second Budget of the Modi 3.0 government and Finance Minister Nirmala Sitharaman’s eighth consecutive Budget presentation. Whether FY 2025-26 will bring a lower income tax burden remains to be seen.

Stay tuned for FM Nirmala Sitharaman’s Budget speech on February 1, which will reveal the much-anticipated tax reforms.

Tags:

Budget 2025, Income Tax Relief, Middle Class Tax Reforms, PM Modi Economic Policies, Union Budget Updates, New Tax Regime, Nirmala Sitharaman Budget Speech