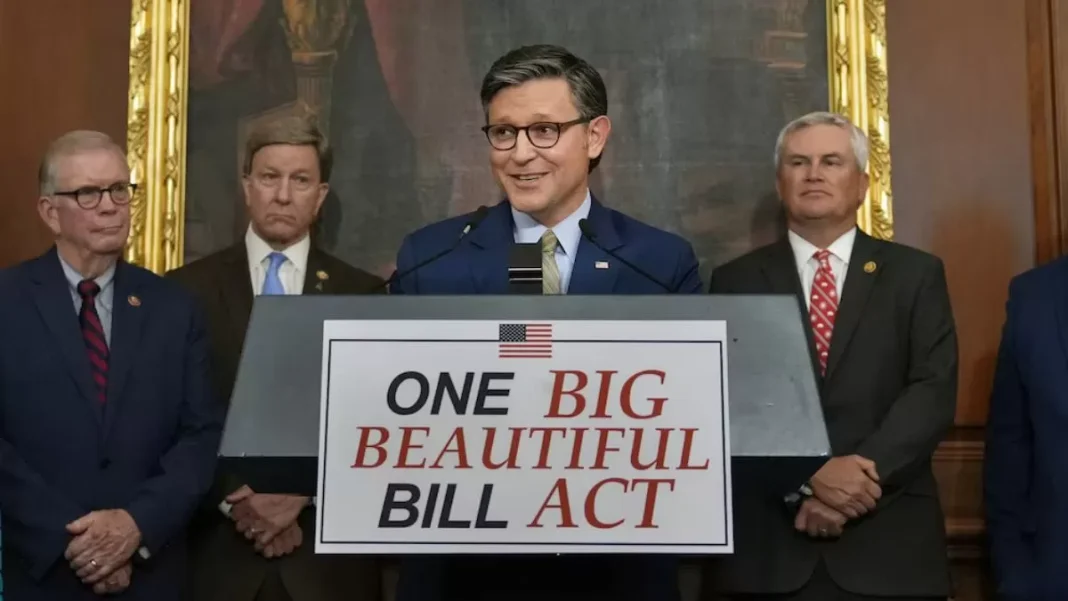

July 10, 2025: The One Big Beautiful Bill Act (OBBBA) has officially become law, bringing major changes to the U.S. tax code. This sweeping legislation includes long-term benefits for businesses and individuals, as well as a mix of controversial tax breaks and compliance challenges.

✅ Key Highlights of OBBBA

1. Permanent Expensing for Investments

One of the most impactful reforms is the permanent expensing for short-lived capital investments and domestic R&D. This provision eliminates the tax penalty on investments and is expected to boost long-term GDP by 0.7%.

2. TCJA Tax Cuts Made Permanent

The individual tax rate cuts and bracket changes from the 2017 Tax Cuts and Jobs Act (TCJA) are now permanent. This includes an expanded standard deduction and adjusted AMT threshold, simplifying taxes for millions.

3. Officer-Level Salary Hikes Under New Fitment Factor

Under the proposed 8th Pay Commission adjustments, officer-level employees may see basic pay hike up to ₹6.42 lakh. The final fitment factor (2.08 to 2.57) will decide the actual raise.

4. Changes to SALT Deduction and Estate Tax

- SALT deduction cap raised to $40,000 (till 2029) for those earning under $500,000.

- Estate and gift tax exemption set at $15 million starting 2026, adjusted for inflation.

Also read: Texas Flood Turns Deadly: 100+ Killed, Children Swept Away at Summer Camp

5. Green Energy Credits Overhauled

IRA’s EV and energy product credits are repealed or phased out faster. However, carbon capture and clean fuel production credits have been expanded under new guidelines.

6. New Tax-Free Savings Scheme: Trump Accounts

A new savings plan allows parents to receive a $1,000 baby bonus and contribute up to $5,000 yearly. Funds grow tax-free until age 18, then convert into a traditional IRA.

❌ Areas of Concern

- New deductions like tax breaks for tips, overtime, and car loans add over $350 billion in costs over 4 years.

- Pass-through business income deduction made permanent, costing $655 billion and complicating tax neutrality.

- Total revenue loss projected at $5 trillion, with a $3 trillion deficit expected over the next decade.

😵 Compliance & Complexity

While the law includes pro-growth reforms, it also adds layers of complexity with new tax credits, savings accounts, and narrowly targeted benefits. Experts warn of increased IRS burden and taxpayer confusion due to overlapping rules and conditions.

Final Verdict

The One Big Beautiful Bill Act locks in many tax cuts from the TCJA and encourages business investment, but it falls short of simplifying the tax code. While the law offers economic growth potential, it increases fiscal pressure and administrative overhead.